nevada estate tax rate

Nevada law requires a person in possession of the deceased persons will. In Nevada if the total amount of the deceased persons assets exceeds 20000 or if real estate is involved probate or administration will be required and there is normally no reason to delay starting the process.

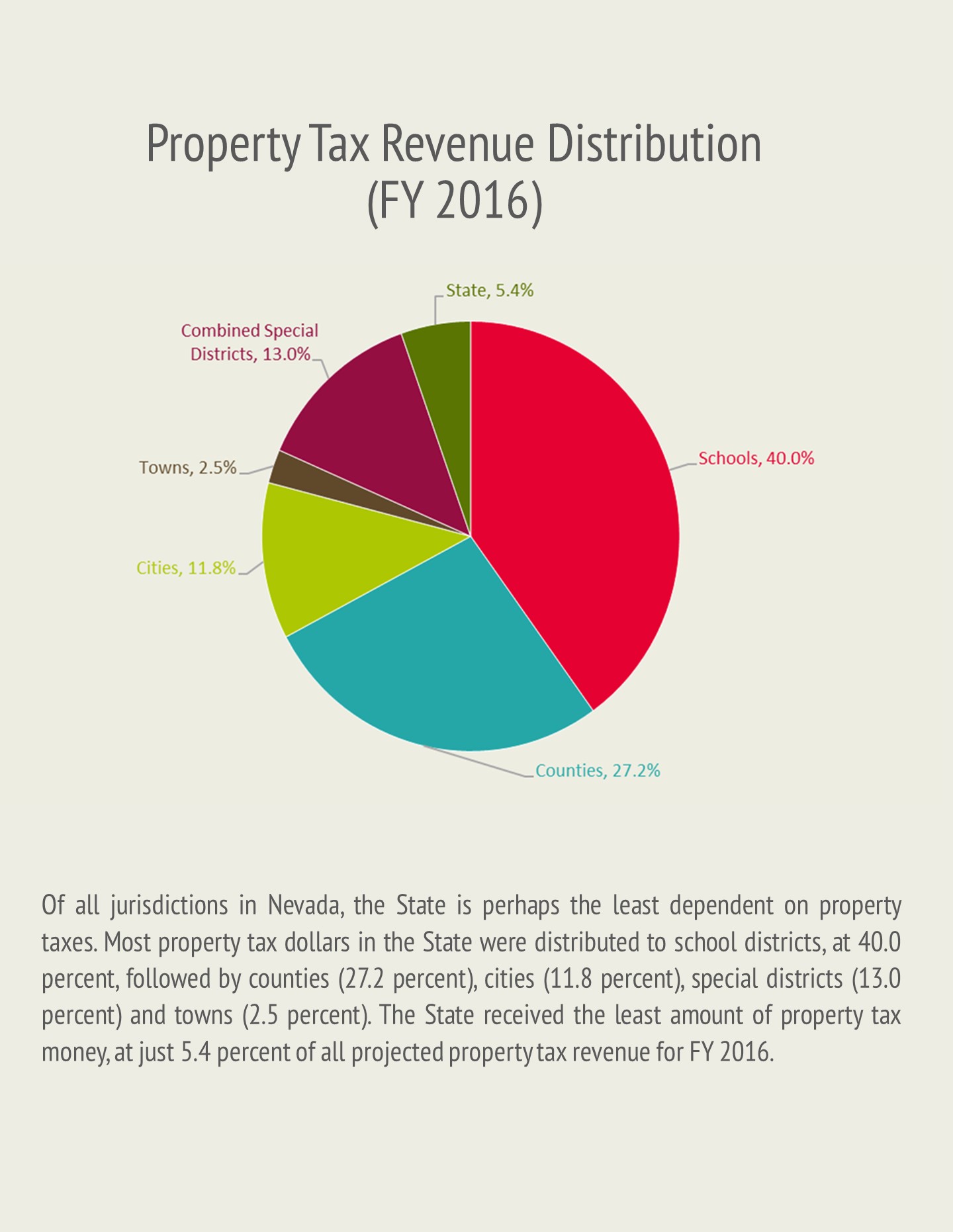

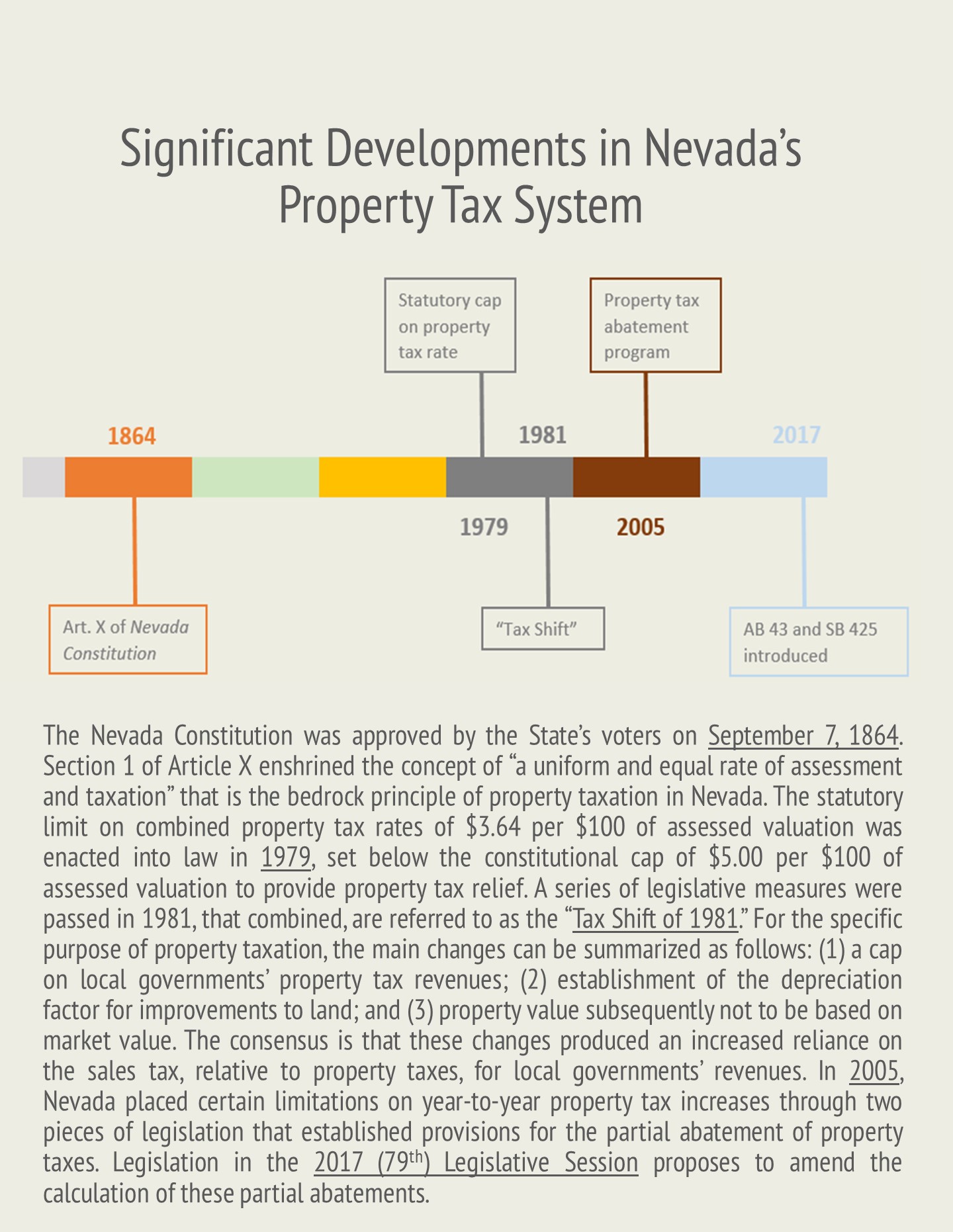

Property Taxes In Nevada Guinn Center For Policy Priorities

Counties and cities can charge an additional local sales tax of up to 125 for a maximum possible combined sales tax of 81.

. Nevada has 249 special sales tax jurisdictions with local sales taxes in. The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794. But the state makes up for this with a higher-than-average sales tax.

Inheritance and Estate Tax Rate Range. Elko is a vibrant city in Northeastern Nevada perfect for retirees who arent in the mood to live near the energetic city of Las Vegas. Catherine Cortez Masto said she proposed a federal gas tax holiday that will help us lower costs for Nevada families But her bill.

Tax rate of 05 on the first 2000 of taxable income. Counties and cities are not allowed to collect local sales taxes. Nevada is one of the seven states with no income tax so the income tax rates regardless of how much you make are 0 percent.

Number of Hospitals Within 25 Miles of the City. Groceries and prescription drugs are exempt from the Maine sales tax. Maine has a higher state sales tax than 808 of.

The Virginia tax rate and tax brackets are unchanged from last year. Maine has no special sales tax jurisdictions with local sales taxes in addition to the state sales tax. As soon as practical following the persons death.

Grantor trust excluding a trust taxable as a business entity for federal tax purposes. I am a small business owner and my revenue is less than. The table below shows the county and city rates for every county and the largest cities in the state.

Nevada has the 13th highest combined average. Virginia Income Tax Rate 2020 - 2021. Most Recent Annual Number of Property Crimes.

Tax rate of 3 on taxable income between 3751 and 4900. Nevada State Personal Income Tax. Property Tax Rate Range.

Groceries and prescription drugs are exempt from the Nevada sales tax. If your Nevada gross revenue during a taxable year is over 4000000 you are required to file a Commerce Tax return. Most Recent Annual Number of Violent Crimes.

Tax rate of 5 on taxable income over 7200. Percentage of the Population Over 65. Estate of a natural person.

For married taxpayers living and working in the state of Oklahoma. Virginia state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VA tax rates of 2 3 5 and 575 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Tax rate of 2 on taxable income between 2501 and 3750.

Tax rate of 4 on taxable income between 4901 and 7200. Nevada Sales Tax Nevadas statewide sales tax rate of 685 is eighth-highest in the US. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55.

You are no longer required to file a Commerce Tax return for 2018-2019 tax year and after. Local sales tax rates can raise the sales tax up to 8265.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Taxes In Nevada U S Legal It Group

Nevada Vs California Taxes Explained Retirebetternow Com

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes In Nevada Guinn Center For Policy Priorities

States With Highest And Lowest Sales Tax Rates

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation